Payroll & Tax Law 2025 Updates | HR.1.OBBBA Course

Payroll & Tax Law 2025 Updates | HR.1.OBBBA Course

Couldn't load pickup availability

Payroll Made Simple: Stay Ahead of 2025 Tax & H.R.1 OBBBA Changes

The latest legislative updates don't have to cause payroll headaches. In this course, discover practical tips to streamline your processes, adjust your software, and confidently answer employee questions about these new rules.

By the end of this course, participants will be able to:

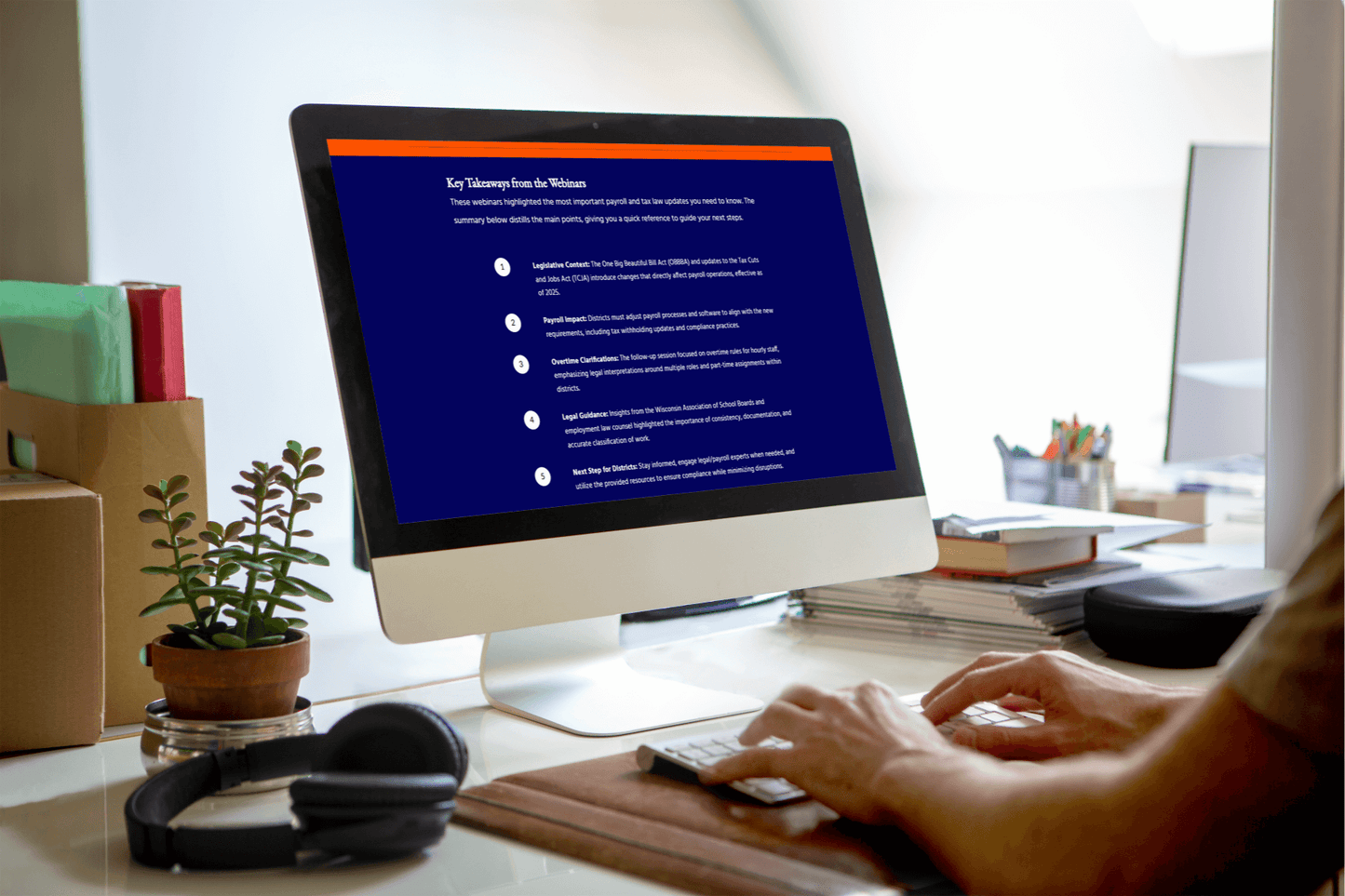

- Summarize the key provisions of H.R.1 The One Big Beautiful Bill Act (OBBBA) and recent Tax Cuts and Jobs Act (TCJA) updates.

- Identify the payroll implications of these legislative changes for employers and employees.

- Recognize necessary updates or adjustments in payroll software to maintain compliance.

- Apply strategies from the webinar to ensure timely and accurate payroll processing under the new requirements.

- Access and reference additional resources to support ongoing compliance and implementation.

Target Audience:

Payroll Specialists

Format:

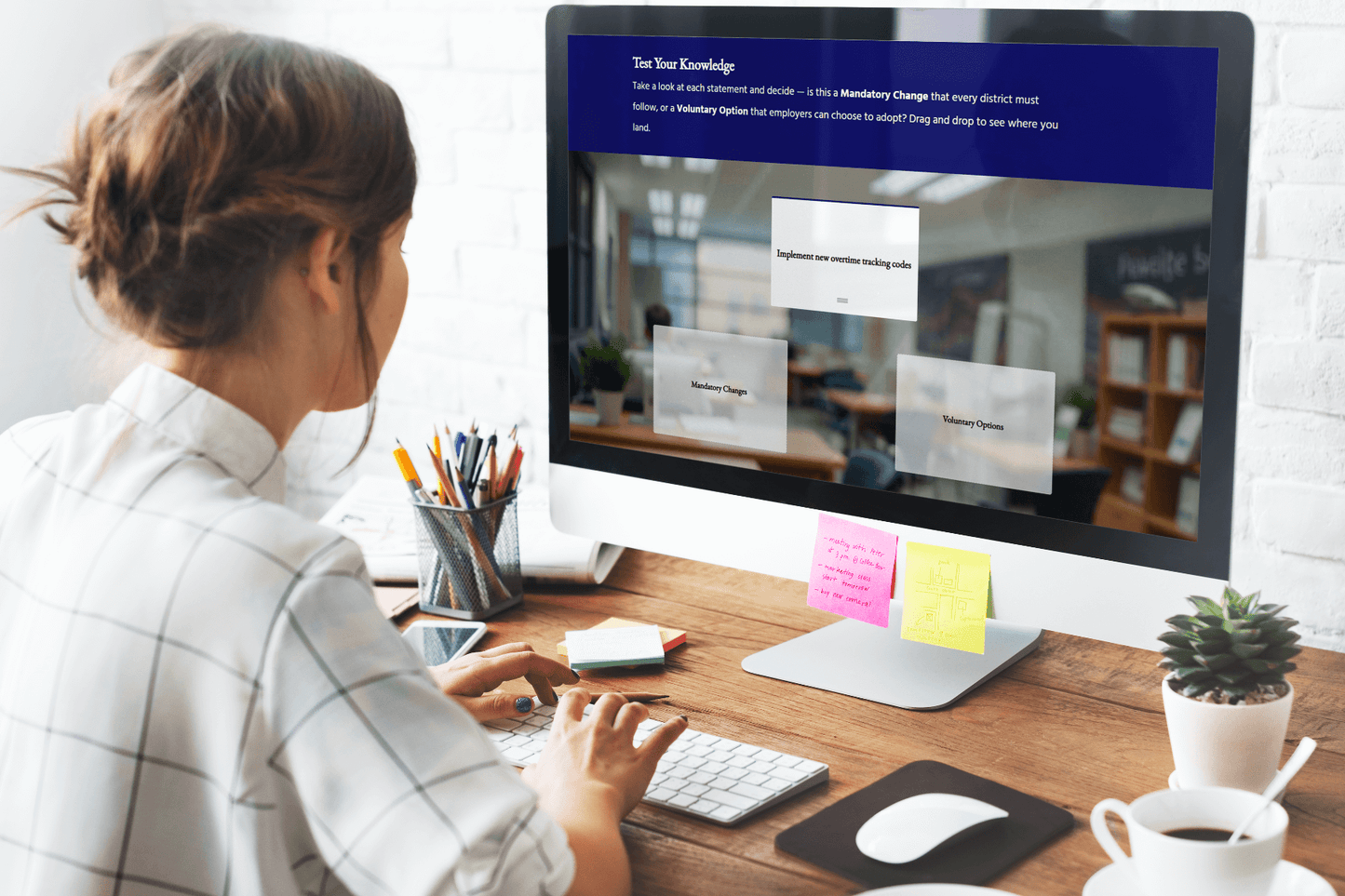

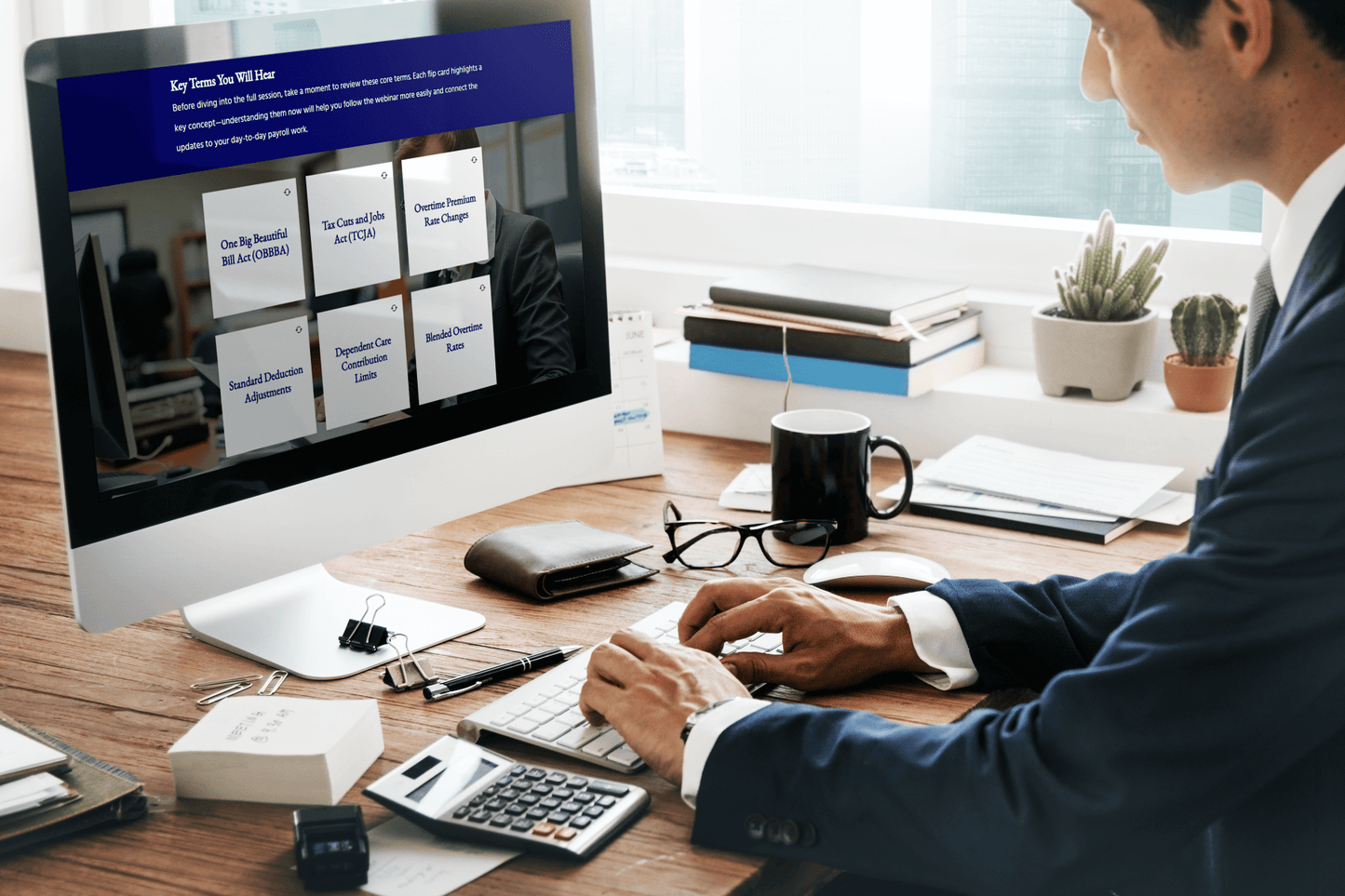

- Self-paced eLearning course with embedded webinar clips, interactive knowledge checks, and real-world scenarios.

- The estimated time to take the course is 60 minutes.

-

Impactful & Affordable

Access ready-to-use tools that fit your role, your budget, and your busy schedule.

-

Built by Educators

Our products are crafted by experts to support real classroom success.

-

Satisfaction Guaranteed

If it’s not the right fit, we’ll make it right—or refund your purchase.

Frequently Asked Questions

How can I contact CESA 6?

When can I expect my items?

You can expect to receive any physical products within 4-7 business days. Digital downloads will be delivered via email immediately following your purchase.

Does CESA 6 accept returns?

If you are not satisfied with your purchase, you may return most items within 30 days of the original purchase date. Returned items must be in unused and original condition with all packaging and items intact. To start a return, you can contact us at shop@cesa6.org. Return shipping costs are the customer's responsibility. Certain items cannot be returned, such as digital downloads, access to online courses, custom orders, and final sale items.

How can I apply my organization's tax exempt status to my order?

If you are a tax-exempt organization, please send a copy of your tax-exempt certificate along with the name and business email address associated with the tax exempt account to shop@cesa6.org. You will receive an email notification when the tax exemption has been applied to your account, which will then be applied to all eligible future orders.

Who is CESA 6?

We are a member-driven cooperative educational service agency located in Wisconsin. We serve school systems within our region, throughout the state, and across the country by providing educators with the latest technology, innovative resources, and valuable guidance from our experienced experts. Read more here.

More questions? Contact us