2025 Payroll Year End and 2026 Payroll Start: Quick Reference Sheets for School Payroll Teams

2025 Payroll Year End and 2026 Payroll Start: Quick Reference Sheets for School Payroll Teams

Couldn't load pickup availability

Your essential reference for a smooth payroll closeout and confident new-year start.

Stay ahead of critical deadlines, compliance updates, and payroll changes with this concise, easy-to-use set of handouts from CESA 6. Designed specifically for Wisconsin school districts and agencies, these reference sheets also include key federal payroll and tax guidance to support accurate reporting and planning as you close out 2025 and prepare for 2026.

Perfect for payroll staff, business managers, and HR professionals, this resource puts the most important information at your fingertips. Saving time, reducing errors, and bringing confidence to your year-end and new-year processes.

What’s Included:

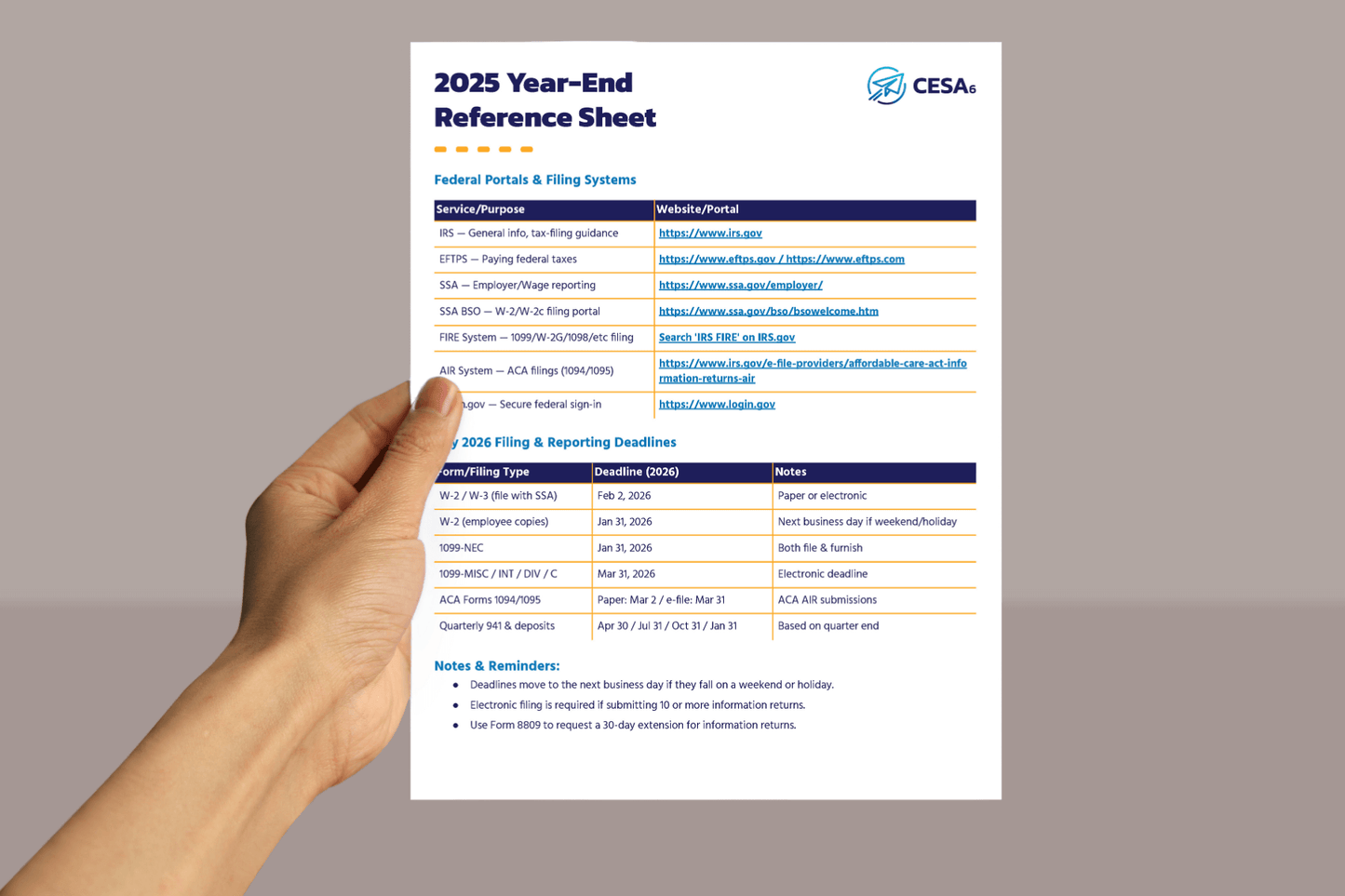

- 2025 Year-End Payroll Reference Sheet: Key federal portals, filing systems, and important reporting deadlines for W-2s, 1099s, ACA forms, and quarterly filings as you close the calendar year.

- 2026 Payroll & Compliance Reference: Up-to-date payroll tax rates, wage bases, retirement contribution limits, and federal bank holidays for the new year.

- Wisconsin Retirement System (WRS) annual reconciliation timelines and employer reporting expectations: including key January deadlines and spring statements for employees.

- Federal overtime guidance under the OBBBA: for school districts, clarifying how FLSA-required overtime premiums may impact employee tax deductions and payroll reporting responsibilities.

- Customizable Sample Statement to Use on Your Letterhead: for Overtime Wages for H.R. 1 OBBBA.

Type: Digital Download PDFs and Customizable Sample Statement (Docx)

Pages: 5 total

Single Use License:

By purchasing this digital booklet, you are granted a single-user license for personal, non-commercial use. Redistribution, resale, or sharing of this material with others, whether in printed or digital format, is strictly prohibited.

-

Impactful & Affordable

Access ready-to-use tools that fit your role, your budget, and your busy schedule.

-

Built by Educators

Our products are crafted by experts to support real classroom success.

-

Satisfaction Guaranteed

If it’s not the right fit, we’ll make it right—or refund your purchase.

Frequently Asked Questions

How can I contact CESA 6?

When can I expect my items?

You can expect to receive any physical products within 4-7 business days. Digital downloads will be delivered via email immediately following your purchase.

Does CESA 6 accept returns?

If you are not satisfied with your purchase, you may return most items within 30 days of the original purchase date. Returned items must be in unused and original condition with all packaging and items intact. To start a return, you can contact us at shop@cesa6.org. Return shipping costs are the customer's responsibility. Certain items cannot be returned, such as digital downloads, access to online courses, custom orders, and final sale items.

How can I apply my organization's tax exempt status to my order?

If you are a tax-exempt organization, please send a copy of your tax-exempt certificate along with the name and business email address associated with the tax exempt account to shop@cesa6.org. You will receive an email notification when the tax exemption has been applied to your account, which will then be applied to all eligible future orders.

Who is CESA 6?

We are a member-driven cooperative educational service agency located in Wisconsin. We serve school systems within our region, throughout the state, and across the country by providing educators with the latest technology, innovative resources, and valuable guidance from our experienced experts. Read more here.

More questions? Contact us